VSEA’s Week In Action Newsletter: May 13, 2022!

Lawmakers Adjourn. Pay Act Funded!

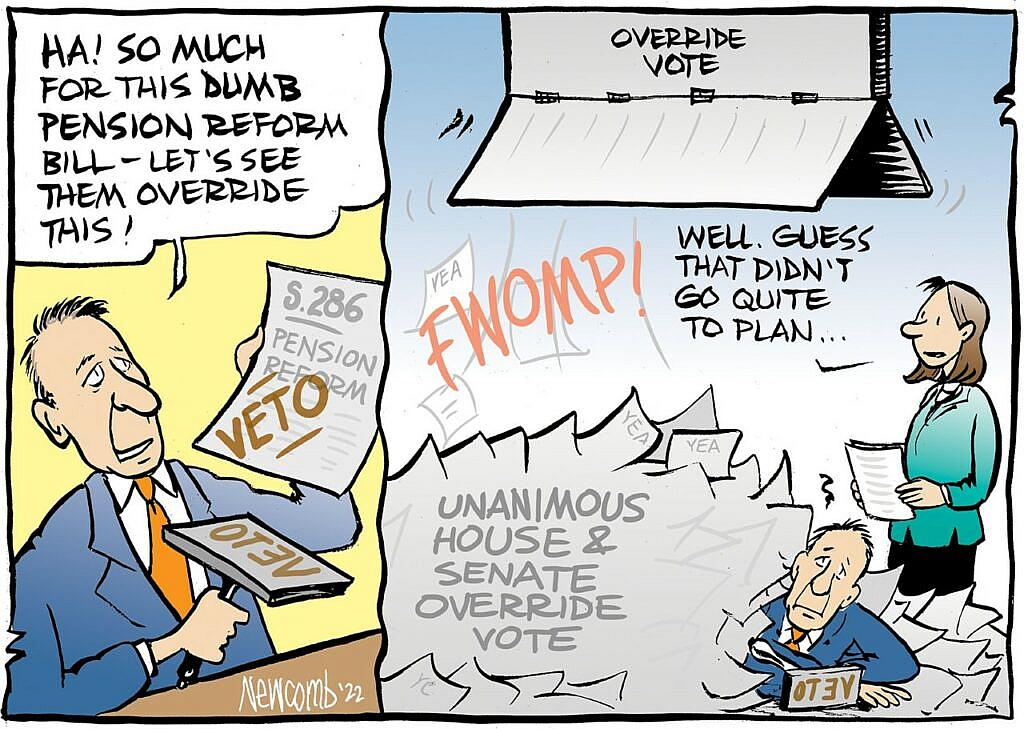

What Does The New Pension Bill Do?

Overwhelming Number Of State Workers Are Vaccinated

The Time To Request A Class-Action RFR Is Now

District Board Seats Up For Election

Facebook Group Created For Department Of Health Members!

Time To Enroll In The Delta Dental Supplemental Plan

Travelers Auto and Home Insurance Program For VSEA Members

Sign Up For AFLAC Through VSEA!

Reminders:

Active & Retired Veterans Are Encouraged To Join The VSEA Veterans Council

VSEA Diversity Committee Seeking Additional Members

Upcoming VSEA Steward And Officer Trainings

Download Your Contract On VSEA.org!

Solidarity Stories:

Letter Carriers’ Union Annual Food Drive Is Tomorrow, May 14!

VPR Reports On Interest In Unions Growing Nationwide

Stand With South Burlington Starbucks Workers!

Subscribe To Week In Action Here